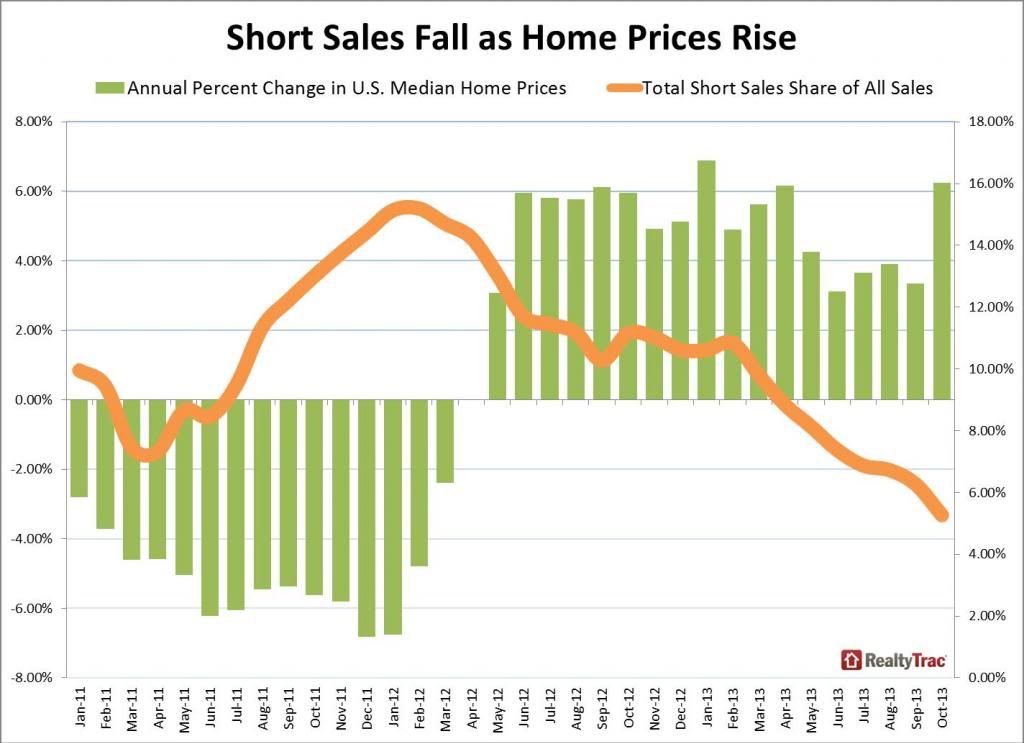

The national median sales price of all residential properties — including both distressed and non-distressed sales — was $170,000, unchanged from September but up 6% from October 2012, the 18th consecutive month median home prices have increased on an annualized basis.

The median price of a distressed residential property — in foreclosure or bank owned — was $110,000 in October, 41% below the median price of $185,000 for a non-distressed property.

“The combination of rapidly rising home prices, along with strong demand from institutional investors and other cash buyers able to buy at the public foreclosure auction or bank owned REO sale, means short sales are becoming less favorable for lenders,” said RealtyTrac Vice President Daren Blomquist in a statement.

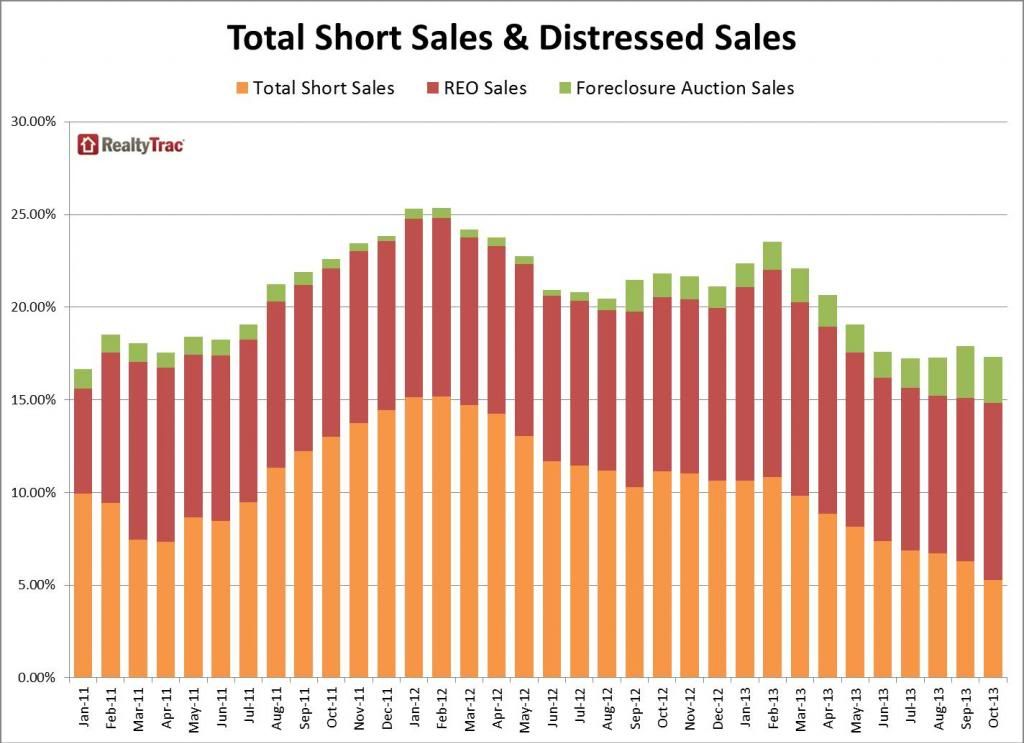

Inventory shortages are part of the picture — last week Lender Processing Services reported that after 18 straight months of declines, U.S. foreclosure inventory is now at its lowest point since the end of 2008, falling nearly 30% from just one year ago to 1.28 million in October. RealtyTrac said short sales represented just 5.3% of all sales in October, down from 6.3% in September and 11.2% at the same time a year ago.

Foreclosure auction sales to third parties (a new category, separated out in the report for the first time) represented 2.5% of all sales, down from 2.8% in September but nearly twice the 1.3% seen at the same time a year ago. Sales of “real estate owned” (REO) homes repossessed by banks accounted for 9.6% of October sales, up from 8.9% in September and 9.4% a year ago.

Talk of institutional investors being scared away by rising prices appears to have been overstated, at least in some markets. Markets with the highest percentage of institutional investor purchases included Memphis (25.4%), Atlanta (23%), Jacksonville, Fla., (22.2%), Charlotte (14.5%), and Milwaukee (12%).

Short sales haven’t gone away altogether — states with the highest proportion of short sales in October included Nevada (14.2%), Florida (13.6%), Maryland (8.2%), Michigan (6.7%), and Illinois (6.2%).

The National Association of Realtors has reported, that tight inventories and rising home prices hampered home purchases in October. Although the U.S. is still seeing “significant supply shortages,” inventories are “stabilizing” compared to the dramatic annual declines seen earlier this year, realtor.com said in releasing October data.

This trend is one that is likely to continue as prices continue to rise and demand remains high. Distressed homeowners and those who are behind on their mortgage, or upside down owing more than their home is worth and wishing to avoid foreclosure should contact a real estate agent specializing in short sales as soon as possible as possible and before getting behind on their mortgage payments if possible. For the banks/loan servicers the determination of whether to approve a short sale is simply a mathematical calculation of which sales method will serve to limit the bank's, and/or it's investor's losses. The best way to limit the bank's losses and to enhance chance of a short sale approval, is to start the process as soon as possible and before the bank has incurred additional expenses including: back property taxes, homeowner's association or condo dues, legal expenses relating to the foreclosure process, etc.

If you’re facing foreclosure you’re facing some very important decisions. We want you know you’re not alone and we are here to help with any questions you may have to assist you in making the best decisions for your situation. There is no charge for this service and we are happy to help! We offer confidential and professional real estate advice.

The Opland Group Specializes in Real Estate Sales, Luxury Home Sales, Short Sales in; Bexley Columbus Delaware Downtown Dublin Gahanna Grandview Heights Granville Grove City Groveport Hilliard Lewis Center New Albany Pickerington Polaris Powell Upper Arlington Westerville Worthington

Definitions

Distressed sales: sale of a residential property that is actively in the foreclosure process or bank-owned when the sale is recorded.

Distressed discount: percentage difference between the median price of distressed sales and a non-distressed sales in a given geographic area.

Bank-Owned sales: sales of residential properties that have been foreclosed on and are owned by the foreclosing lender (bank).

Short sales: sales of residential properties where the sale price is below the combined total of outstanding mortgages secured by the property.

Foreclosure Auction sales: sale of a property at the public foreclosure auction to a third party buyer that is not the foreclosing lender.

No comments:

Post a Comment